Sakata Goho (Japanese Original Candlestick Patterns)

1: Introduction – The Spirit of Sakata

In the misty era of Edo-period Japan, a legendary rice trader named Munehisa Homma unlocked the rhythms of the market with a system both elegant and profound. That system, known as Sakata Goho (酒田五法), or “The Five Sakata Rules”, forms the bedrock of Japanese candlestick analysis.

Rooted in the philosophy of harmony, patience, and observation, Sakata Goho offers traders a disciplined path. Before charts were digital, these principles guided traders using brushes, rice paper, and intuition. Today, we adapt these timeless techniques for modern markets.

2: Sakata Goho? (五法)

Sakata Goho consists of five key patterns, each a tale written in candlesticks.

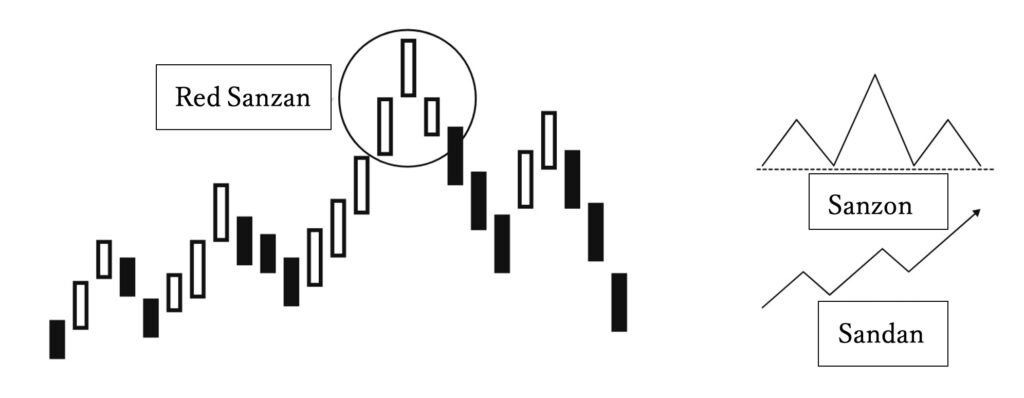

San-Zan (三山) – The Three Mountains

The term Sanzan refers to a pattern representing a major market top. It describes a movement where “the price rises from a bottom, experiences repeated fluctuations, and after three such upward surges followed by pullbacks, it reaches a significant peak.” This concept is commonly interpreted in three ways: the ‘Sandan (Three-Step Rise)’, the Sanzon (‘Head and Shoulders Top’), and the Red Sanzan (‘Three Red Mountains’ formation).

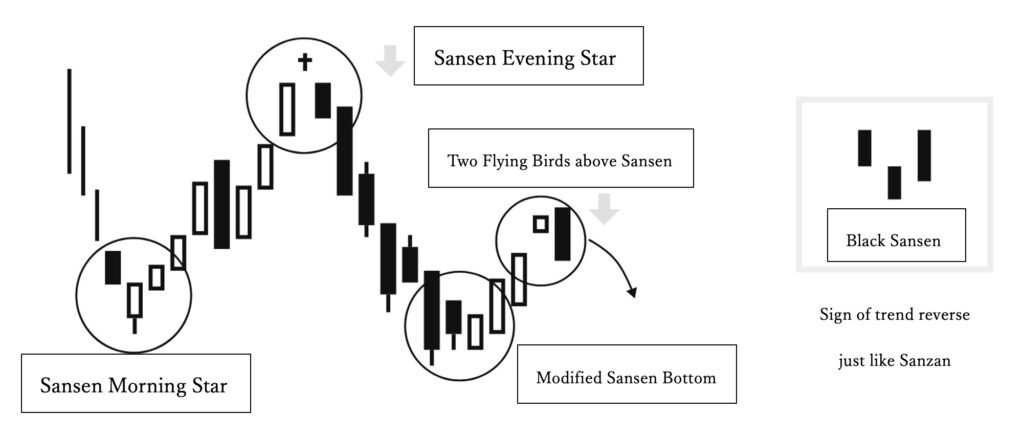

Sansen (三川)- The Three Rivers

“Sansen is the opposite of the Three Mountains. It describes a price movement at the market bottom, where the price repeatedly plunges and rebounds. It signifies a major bottom, typically forming after several months of decline.”

While there are various interpretations of the Sansen pattern, the most well-known are the bullish reversal known as the ‘Sansen Morning Star’ and the bearish reversal called the ‘Sansen Evening Star’, both are three-candlestick reversal patterns occurring within a consolidation range.

However, differing views do exist. Given that Sansen is the counterpart to the Sanzan, some analysts also consider patterns like the Inverted Head and Shoulders and the Bearish Sandan as variations of the Sansen concept.

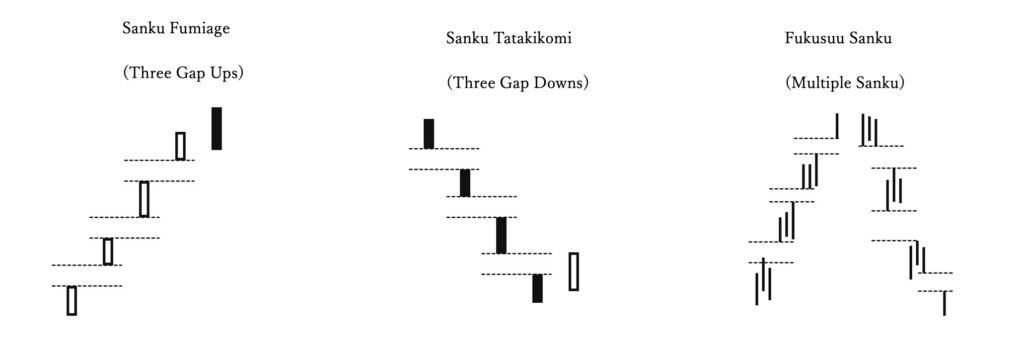

Sanku (三空)- Three Skies

The pattern known as “windows” or “gaps” refers to price areas left unfilled between candlesticks. In the case of a Three Gaps Up (San-Ku Tobiage), the first gap typically reflects strong fresh buying interest. The second gap often signals a retreat by short-sellers and an aggressive buildup of long positions. The third gap marks a full-scale short-covering rally. According to the principles of Sakata Goho, this third gap is a signal to prepare for a reversal and take a contrarian (selling) position.

San-Ku refers to a situation in which the market has matured bullish momentum significantly, and as a result, three consecutive upside gaps (price voids) appear. In such cases, if a retracing candlestick (one that overlaps or negates the previous gap) appears after the third gap, or if no continuation candlestick (a confirming candle) follows, it often signals a major market top.

Furthermore, “there are two types of San-Ku patterns: double-line (fukusen) and single-line (tansen) variations, depending on the structure of the candlesticks involved.”

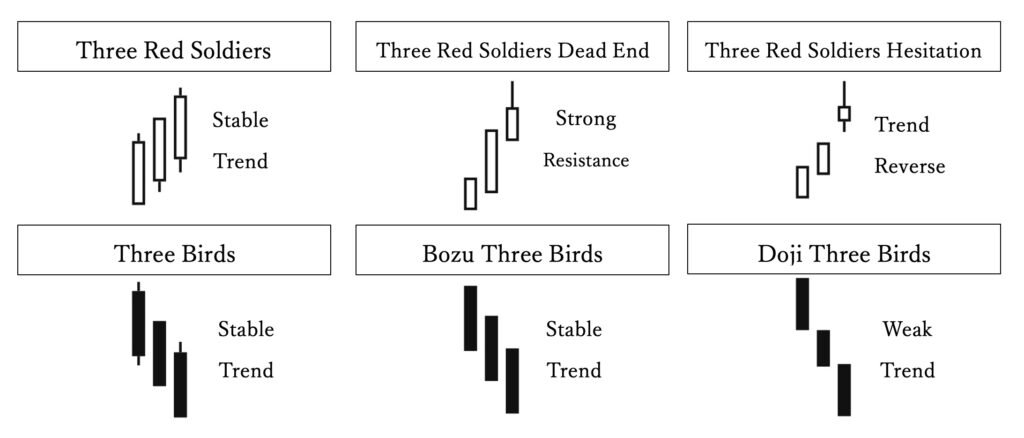

Sanpei (三兵)- Three Soldiers

“Sanpei is a hallmark of the beginning of an upward trend. It appears after a market that has been in a prolonged consolidation. The pattern is formed by three consecutive small-to-medium bullish candlesticks, each closing progressively higher.”

A pattern of three consecutive bullish candlesticks, each closing slightly higher without sharp upward moves, is called Three Red Soldiers (Aka Sanpei). The opposite, three consecutive bearish candlesticks, is known as Three Black Soldiers or Three Birds (Sanbatori).

※ For the Three Birds, it is essential that the first bearish candle opens lower. If it opens higher, it is considered a “Press Down” (Osaekomisen), not a valid Three Birds formation. Also, when three bullish or bearish candles appear in succession, it is important to carefully assess their position within the market’s overall price movement (wave structure) before drawing conclusions.

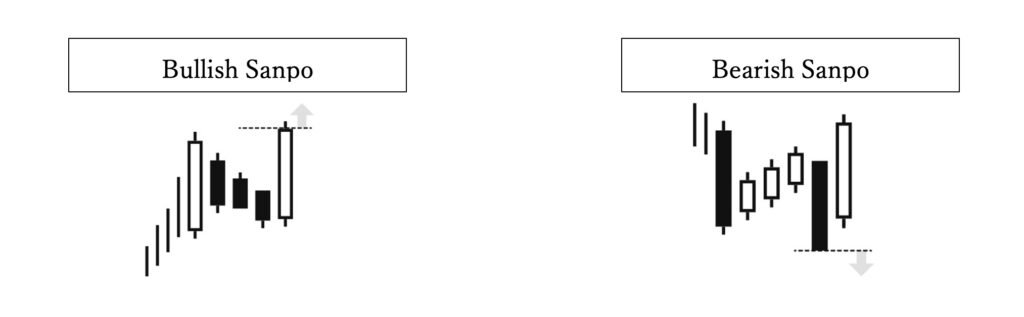

Sanpo (三法)- Three Methods

Bullish Sanpo:

When a large bullish candlestick appears that breaks above a preceding three-candle bearish consolidation, it is seen as a signal that profit-taking has run its course. If the market opens higher the next day, it becomes a buying opportunity.

Bearish Sanpo:

When a bearish candlestick breaks below a preceding three-candle bullish consolidation, it is interpreted as the end of short-covering. This is considered a key moment to add to short positions.